An Arizona lease agreement is a legal contract between a Landlord and a Tenant. This document includes the terms and conditions, including the lease’s duration, rent amount, responsibilities of the landlord and tenant, and regulations for maintenance and repairs.

Most Recent US Home Facts

- Population (2023): 334,914,895

- Median Households (2022): 125,736,353

- Median Household Income (2022): $75,149

- Owner-occupied Households (2022): 64.8%

Source: U.S. Census Bureau

Options By Type

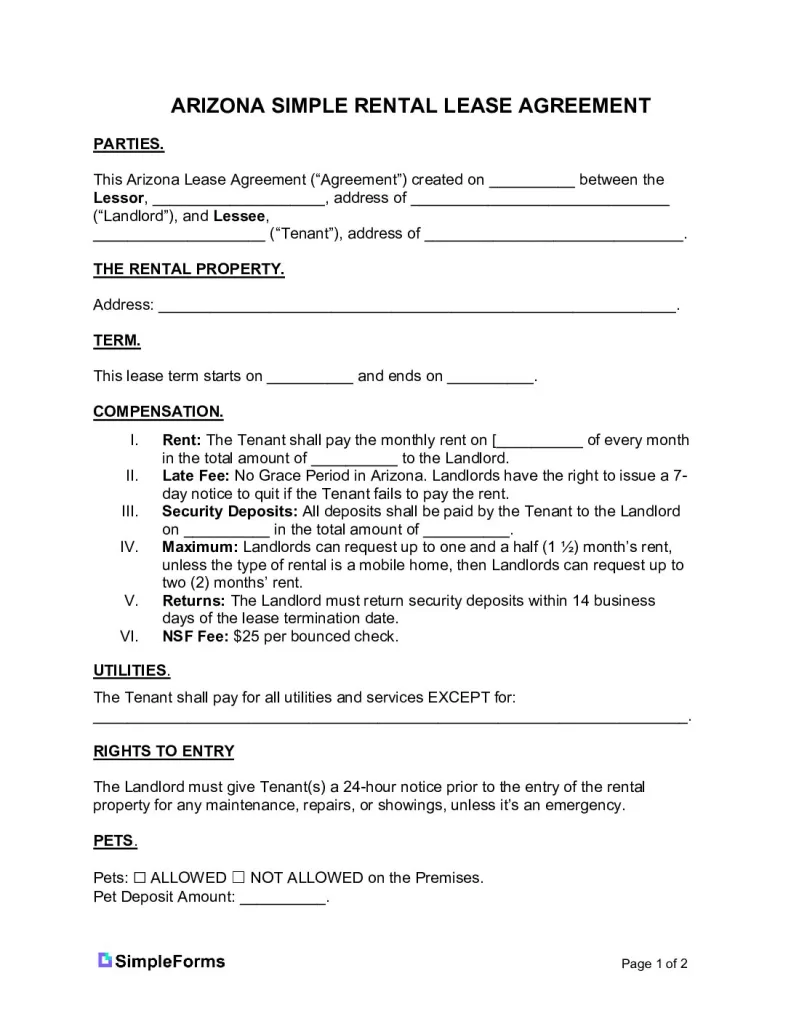

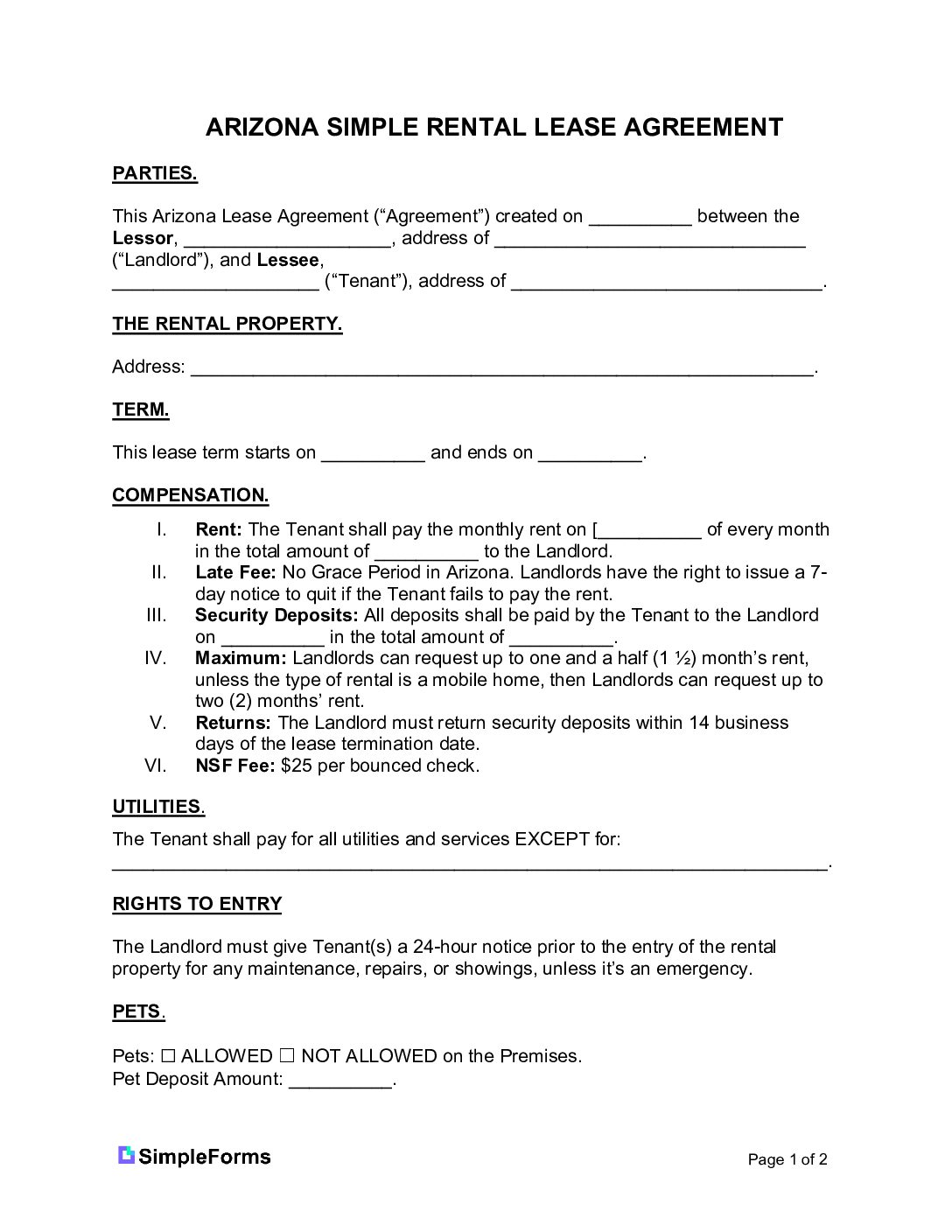

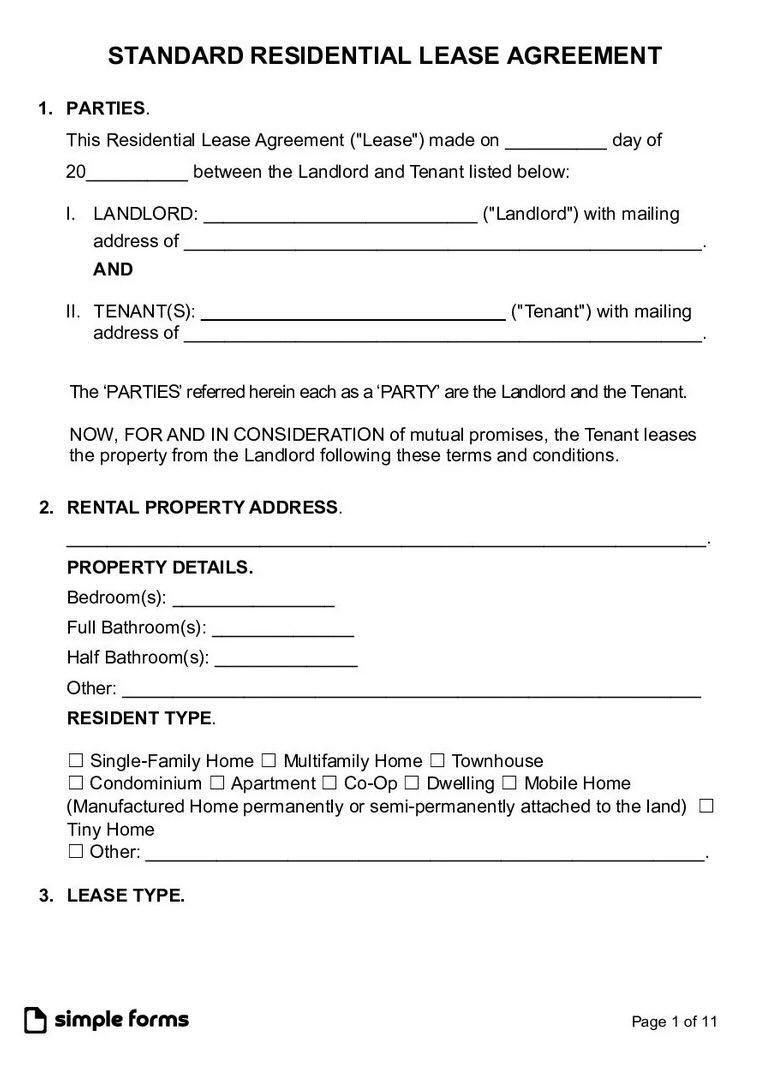

Standard Residential Lease Agreement Standard Residential Lease Agreement

Download: PDF |

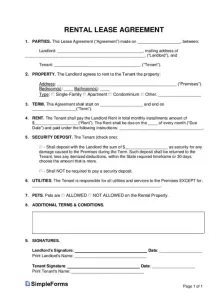

Simple (1-Page) Lease Agreement Simple (1-Page) Lease Agreement

Download: PDF |

What to include in the agreement form?

Required Disclosures

Landlord’s Contact Notice –Landlords must disclose property management contact information and legal notice details in the lease agreement.

Lead-Based Paint Disclosure – Landlords must provide new tenants with information regarding any presence of lead-based paint if property was built before 1978.

Bed Bug Disclosure Form – Landlords must provide educational materials to tenants on bed bug prevention and treatment.

Move-in / Move-out Condition Checklist – Leases require a Move-in / Move-out Condition Checklist. Tenant may not fill it, but Landlord must do a move-out inspection by giving written notice to Tenant before the move-out date.

Landlord Tenant Act Form Copy – The landlord is required to provide the tenant with a copy of the Arizona Residential Landlord and Tenant Act (Title 34, Chapter 3) upon lease signing, as specified in the Landlord-Tenant Act.

Fee Disclosure – Any fees labeled as non-refundable in the agreement are non-refundable.

Pool Safety Notice – Landlords renting a property with a pool must comply with Pool Safety Notice.

Shared Utility Charge Disclosure – If the landlord uses a shared meter to bill the tenant for utility charges, the rental agreement must specify how the costs are calculated. Additionally, the landlord may include administrative costs involved in calculating and paying the utility charges, for which they can reimburse themselves.

Tax Disclosure – The landlord may increase the rent due to changes in the business pass-through tax in the area where the residence is located. However, the landlord must provide the tenant with a notice at least thirty (30) days before the rent increase. This option to increase the rent due to the business pass-through tax must be clearly stated in the lease agreement to be enforceable.

Source: § 33-1322, § 33-1321(C), § 36-1681(E), § 33-1314.01

Right to Enter (Landlord)

Late Fees

Maximum Penalty – There is no statutory maximum penalty that a landlord can charge, but if mentioned in the lease, they can charge any amount.

Manufactured homes – subject to a daily fee of up to $5.00.

NSF Fee – Landlords may charge up to $25 per bounced rent check.

Source: § 33-1414(8)(c)

Security Deposits

Maximum Amount – The landlord may not require a security deposit that exceeds 1.5 times the monthly rent.

Returning to Tenant – It is required that Landlords return security deposits to their Tenants within a period of 14 days following the move-out inspection, exclusive of weekends and holidays. This established time frame must be followed in order to ensure compliance with legal regulations pertaining to landlord-tenant relationships.

Source: § 33-1321

FAQs

- Does Arizona have state income tax? Yes.

- Where is Arizona State University (ASU)? Tempe, Arizona.

- Is Arizona state university accredited? Yes.

- Is Arizona a state? Yes.

- When did Arizona become a state? February 14, 1912.

- Does Arizona has state tax? Yes.

- Is Arizona a community property state? Yes.

- Is Arizona a red or blue state? Arizona is a swing state.

- Is Arizona a stop and ID state? Yes.

- Is Arizona an open carry state? Yes.

- Is Arizona a no fault state? No.

Arizona Real Estate Commission

For any other questions you may have, refer to the Arizona Department of Real Estate.